Extract from a statement announcing devaluation of the pound in November 1967 (PREM 13/1447)

Transcript

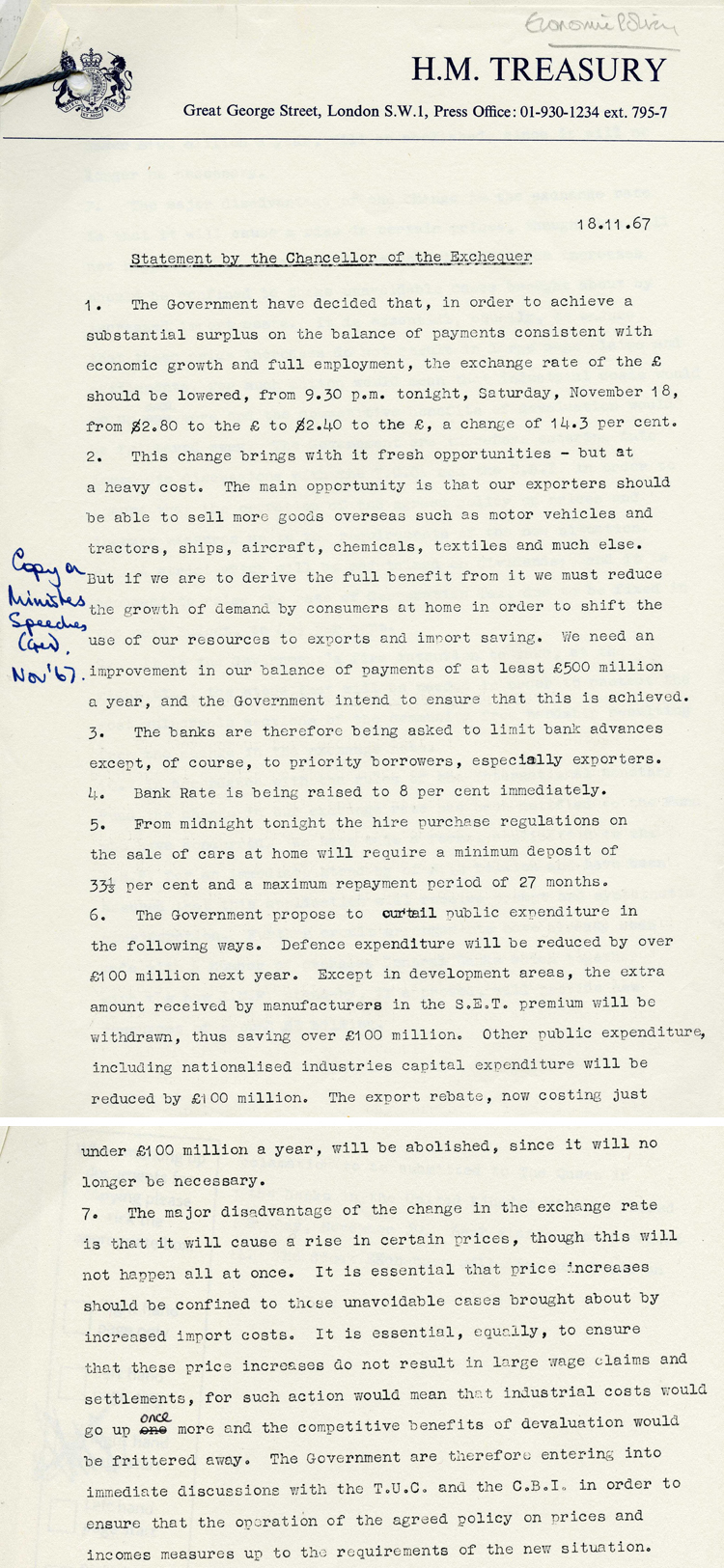

18.11.67

Statement by the Chancellor of the Exchequer

1. The Government have decided that, in order to achieve a substantial surplus on the balance of payments consistent with economic growth and full employment, the exchange rate of the £ should be lowered, from 9.30 p.m. tonight, Saturday, November 18, from $2.80 to the £ to $2.40 to the £, a change of 14.3 per cent.

2. This change brings with it fresh opportunities – but at a heavy cost. The main opportunity is that our exporters should be able to sell more goods overseas such as motor vehicles and tractors, ships, aircraft, chemicals, textiles and much else. But if we are to derive the full benefit from it we must reduce the growth of demand by consumers at home in order to shift the use of our resources to exports and import saving. We need an improvement in our balance of payments of at least £500 million a year and the Government intend to ensure that this is achieved.

3. The banks are therefore being asked to limit bank advances except, of course, to priority borrowers, especially exporters.

4. Bank Rate is being raised to 8 per cent immediately.

5. From midnight tonight the hire purchase regulations on the sale of cars at home will require a minimum deposit of 33.3 per cent and a maximum repayment period of 27 months.

6. The Government propose to curtail public expenditure in the following ways. Defence expenditure will be reduced by over £100 million next year. Except in development areas, the extra amount received by manufacturers in the S.E.T. premium will be withdrawn, thus saving over £100 million. Other public expenditure, including nationalised industries capital expenditure will be reduced by £100 million. The export rebate, now costing just under £100 million a year, will be abolished, since it will no longer be necessary.

7. The major disadvantage of the change in the exchange rate is that it will cause a rise in certain prices, though this will not happen all at once. It is essential that price increases should be confined to these unavoidable cases brought about by increased import costs. It is essential, equally, to ensure that these price increases do not result in large wage claims and settlements, for such action would mean that industrial costs would go up once more and the competitive benefits of devaluation would be frittered away. The Government are therefore entering into immediate discussions with the T.U.C. and the C.B.I. in order to ensure that the operation of the agreed policy on prices and incomes measures up to the requirements of the new situation.