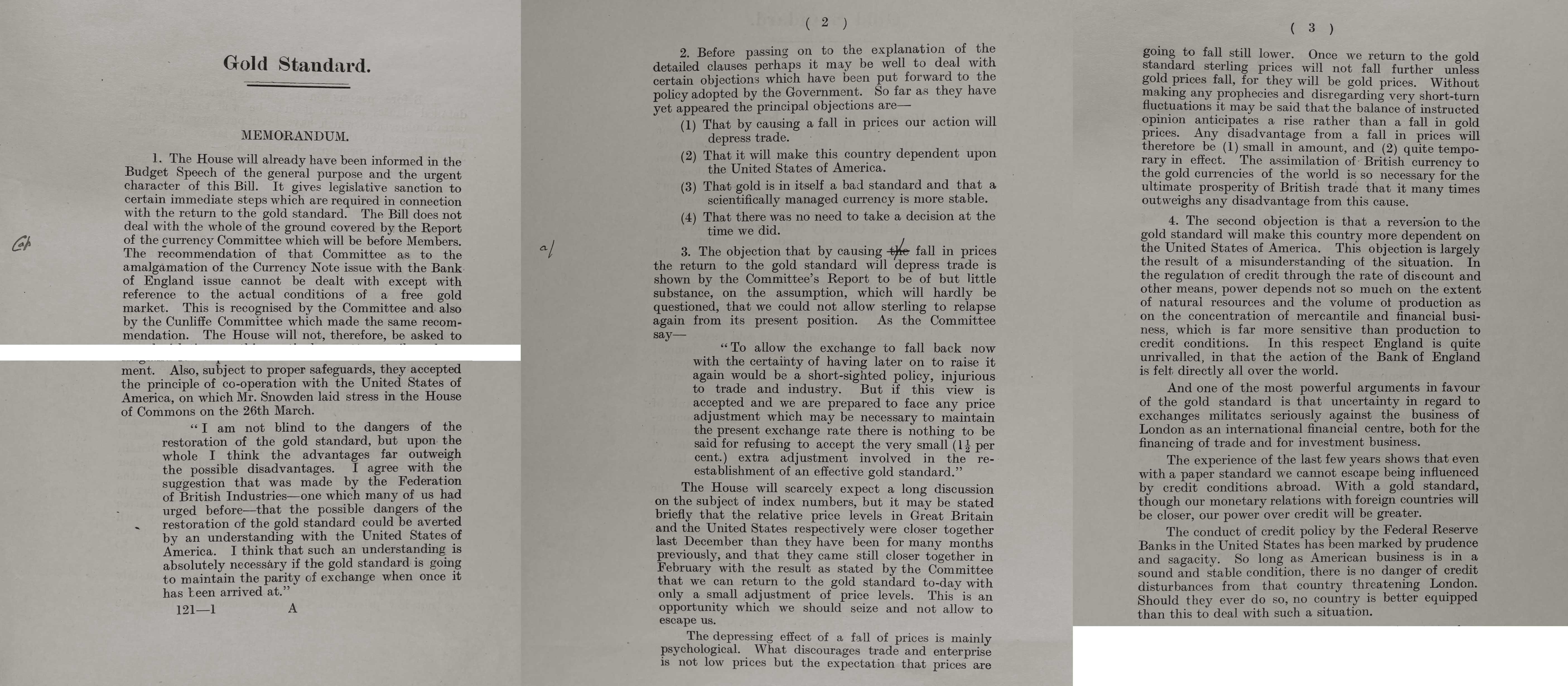

Extract from Treasury Memorandum about going back to Gold standard in 1925 (Catalogue ref: T163/130)

Transcript

Gold Standard

————————-

MEMORANDUM

- The House will already have been informed in the Budget Speech of the general purpose and the urgent character of this Bill. It gives legislative sanction to certain immediate steps which are required in connection with the return to the gold standard. The Bill does not deal with the whole ground covered by the Report of the currency Committee which will be before Members. The recommendation of that Committee as to the amalgamation of the Currency Note issue with the Bank of England cannot be dealt with except with reference to the actual conditions of a free gold market. This is recognised by the Committee and also by the Cunliffe Committee which made the same recommendation. The House will not, therefore, be asked to pass legislation on this particular matter until we have further experience and able to fix with more accuracy than we can today the amount of the gold reserves and of the functionary circulation

[…]

Also, subject to proper safeguards, they accepted the principle of co-operation with the United States of America, on which Mr. Snowden laid stress in the House of Commons on the 26th March.

“I am not blind to the dangers of the restoration of the gold standard, but upon the whole I think the advantages far outweigh the possible disadvantages. I agree with the suggestion that was made by the Federation of British Industries-which many of us had urged before-that the possible dangers of the restoration of the gold standard could be averted by an understanding with the United States of America. I think that such an understanding is absolutely necessary if the gold market is going to maintain the parity of exchange when once it has been arrived at.”

- Before passing on to the explanation of the detailed clauses perhaps it may be well to deal with certain objections which have been put forward to the policy adopted by the Government. So far as they have yet appeared the principal objections are—

- That by causing a fall in prices our action will depress trade.

- That it will make this country dependent upon the United States of America.

- That gold is in itself a bad standard and that a scientifically managed currency is more stable.

- That there was no need to take a decision at the time we did.

- The objection that by causing the fall in prices the return to the gold standard will depress trade is shown by the Committee’s Report to be of but little substance, on the assumption, which will hardly be questioned, that we could not allow sterling to relapse again from its present position. As the Committee say—

“To allow the exchange to fall back now with the certainty of having later on to raise it again would be a short-sighted policy, injurious to trade and industry. But if this view is accepted and we are prepared to face any price adjustment which may be necessary to maintain the present exchange rate there is nothing to be said for refusing to accept the very small (1½ per cent.) extra adjustment involved in the re-establishment of an effective gold standard.”

The House will scarcely expect a long discussion on the subject of index numbers, but it may be stated briefly that the relative price levels in Great Britain and the United States respectively were closer together last December than they have been for many months previously, and that they came still closer together in February with the result as stated by the Committee that we can return to the gold standard today with only a small adjustment of price levels. This is an opportunity which we should seize and not allow to escape us.

The depressing effect of a fall in prices is mainly psychological. What discourages trade and enterprise is not low prices but the expectation that prices are going to fall still lower. Once we return to the gold standard sterling prices will not fall further unless gold prices fall, and they will be gold prices. Without making any prophesies and disregarding very short-turn fluctuations it may be said that the balance of instructed opinion anticipates a rise rather than a fall in gold prices. Any disadvantage from a fall in prices will therefore be (1) small in amount and (2) quite temporary in effect. The assimilation of British currency to the gold currencies of the world is so necessary for the ultimate prosperity of British trade that it many times outweighs any disadvantage from this cause.

- The second objection is that a reversion to the gold standard will make this country more dependent on the United States of America. This objection is largely the result of a misunderstanding of the situation. In the regulation of credit through the rate of discount and other means, power depends not so much on the extent of natural resources and the volume of production as on the concentration of mercantile and financial business, which is far more sensitive than production to credit conditions. In this respect England is quite unrivalled, in that the action of the Bank of England is felt directly all over the world.

And one of the most favourable arguments in favour of the gold standard is that uncertainty in regard to exchanges militates seriously against the business of London as an international financial centre, both for the financing of trade and for the investment business.

The experience of the last few years shows that the even with a paper standard we cannot escape being influenced by credit conditions abroad. With a gold standard, though our monetary relations with foreign countries will be closer, our power over credit will be greater.

The conduct of credit policy by the Federal Reserve Banks in the United States has been marked by prudence and sagacity. So long as American business is in a sound and stable condition, there is no danger of credit disturbances from that country threatening London. Should they ever do so, No country is better equipped than this to deal with such a situation.