Treasury statement for the Press on Britain leaving the Gold Standard, 20th September 1931 (T 163/68/18)

Transcript

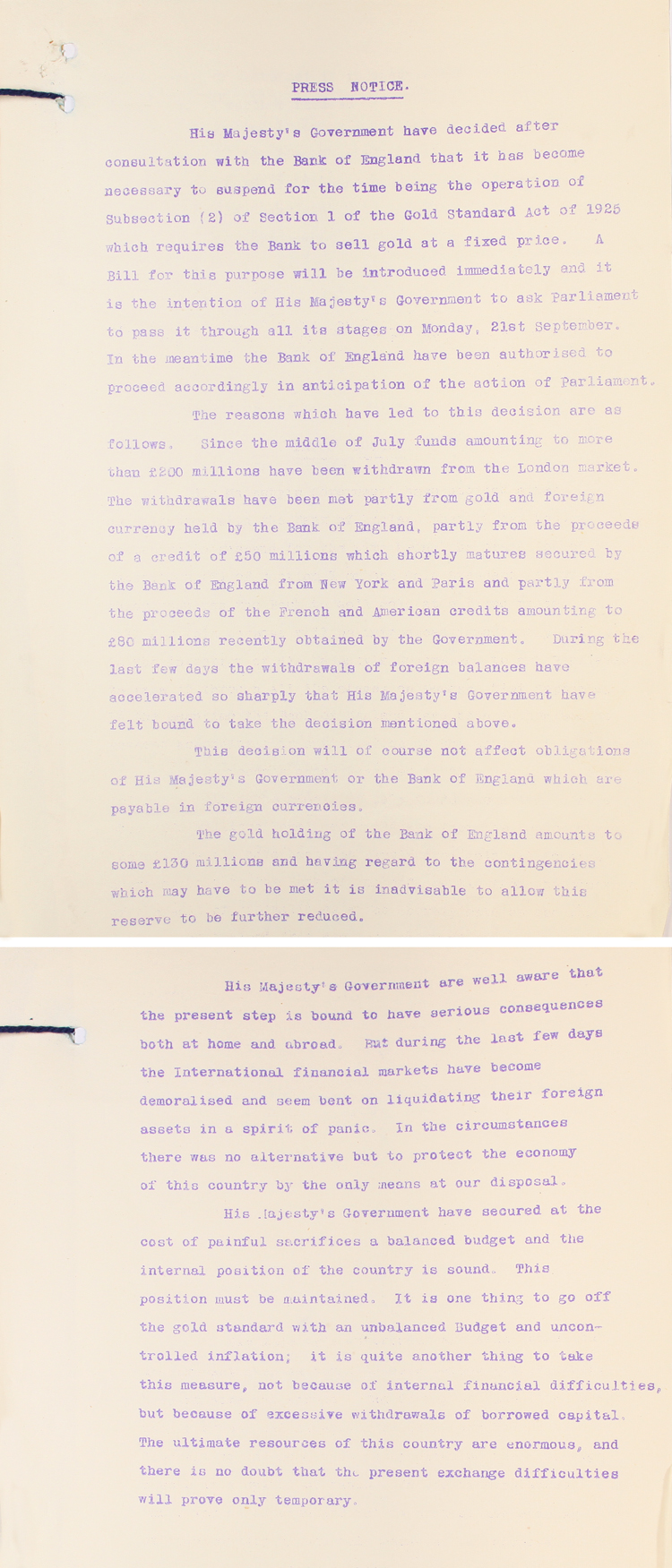

PRESS NOTICE

His Majesty’s Government have decided after consultation with the Bank of England that it has become necessary to suspend for the time being the operation of Subsection (2) of Section 1 of the Gold Standard Act of 1925 which requires the Bank to sell gold at a fixed price. A bill for this purpose will be introduced immediately and it is the intention of His Majesty’s Government to ask Parliament to pass it through all its stages on Monday, 21st September. In the meantime the Bank of England have been authorised to proceed accordingly in anticipation of the action of Parliament.

The reasons which have led to this decision are as follows. Since the middle of July funds amounting to more than £200 million have been withdrawn from the London market. The withdrawals have been met partly from gold and foreign currency held by the Bank of England, partly from the proceeds of a credit of £50 million which shortly matures secured by the Bank of England from New York and Paris and partly from the proceeds of the French and American credits amounting to £50 millions recently obtained by the Government. During the last few days the withdrawals of foreign balances have accelerated so sharply that His Majesty’s Government have felt bound to take the decision mentioned above.

This decision will of course not affect obligations of His Majesty’s Government or the Bank of England which are payable in foreign currencies. The gold holding of the Bank of England amounts to some £130 million and having regard to the contingencies which may have to be met it is inadvisable to allow this reserve to be further reduced.

His Majesty’s Government are well aware that the present step is bound to have serious consequences both at home and abroad. But during the last few days the International financial markets have become demoralised and seem bent on liquidating their foreign assets in a spirit of panic. In the circumstances there was no alternative but to protect the economy of this country by the only means at our disposal.

His Majesty’s Government have secured at the cost of painful sacrifices a balanced budget and the internal position of the country is sound. This position must be maintained. It is one thing to go off the gold standard with an unbalanced Budget and uncontrolled inflation, it is quite another thing to take this measure, not because of internal financial difficulties, but because of excessive withdrawals of borrowed capital. The ultimate resources of this country are enormous, and there is no doubt that the present exchange difficulties will prove only temporary.