How to look for records of... Land use, value and ownership: Valuation Office Survey 1910-1915

How can I view the records covered in this guide?

How many are online?

- None

Contents

- 1. Why use this guide?

- 2. The Valuation Office and the survey

- 3. The records and their content

- 4. Online records

- 5. How to find plans (maps)

- 6. How to find field books

- 7. How to find valuation books

- 8. How to find survey forms

- 9. Records on the work of the Valuation Office

- 10. The Finance (1909-1910) Act and its legacy

- 11. Further reading

- 12. Appendices

1. Why use this guide?

If you want to know something about the value, use, extent or ownership of a property or piece of land in England or Wales around the beginning of the 20th century, this guide should be of use.

This is a guide to finding records of the Valuation Office Survey which was carried out between 1910 and 1915. The survey provided a unique snapshot of land and property in the Edwardian era, assessing its worth, how it was used and by whom and in so doing inadvertently painting a picture of society itself.

Contact The National Records of Scotland for records of the Valuation Office in Scotland and The National Archives of Ireland for records of the Valuation Office in Ireland.

Some records of the Valuation Office Survey are available to see online, see the Online records section for more details.

2. The Valuation Office and the survey

The survey took place as a result of the 1909-1910 Finance Act which provided for the levy and collection of a duty on land in the United Kingdom based on any increased value of the land as a result of public money spent on communal infrastructure – a so-called ‘increment value duty’.

The Valuation Office was set up by the Inland Revenue in 1910 for England and Wales (and in 1911 for Scotland) to make valuations of property for Estate Duty purposes, and was then set to carry out the work of the Survey. 118 valuation districts were established in England and Wales, each in the charge of a district valuer and each comprised a number of income tax parishes. It was through these valuation districts and income tax parishes that the work of the survey was organised and carried out.

3. The records and their content

The two main types of Valuation Office Survey records at The National Archives are Ordnance Survey maps (often referred to as ‘plans’) with manuscript annotations, and accompanying ‘field books’. The field books contain information collected about properties during the Survey. Generally, you need to consult the plans for a place first before you can find the respective field book.

Records for some areas do not survive, largely as a result of the bombing of Valuation Offices during the Second World War. Areas known to be affected include:

- Basildon

- Chelmsford

- Liverpool

- Birkenhead and most of the Wirral

- Coventry

- Portsmouth

- Southampton

- Winchester

Where plans do not survive, you might contact the relevant local record office for surviving working plans or valuation books which may help you to find field books.

3.1 Plans (maps)

The plans are printed Ordnance Survey map sheets, annotated by the Valuation Office surveyors, and act as a visual index to the field books. The surveyors marked the plans with plot numbers, referred to as assessment numbers, which act as a means of reference to the field books.

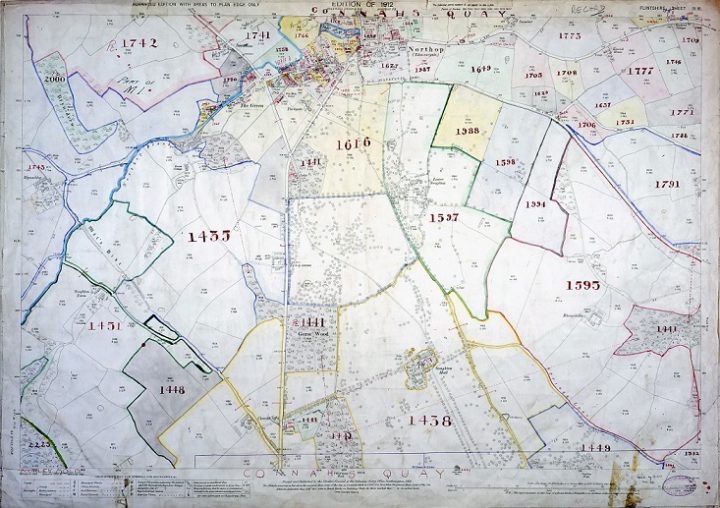

A plan for the town of Connah’s Quay and the surrounding land, in the valuation district of Wrexham, in the county of Flintshire (catalogue reference IR 131/10/85).

Two sets of plans were created. Those used as working documents in the course of the original valuation, where they survive, are held at local archives. Surviving record plans created after the valuation was completed are held at The National Archives. See section 4 for advice on how to find plans.

3.2 Field books

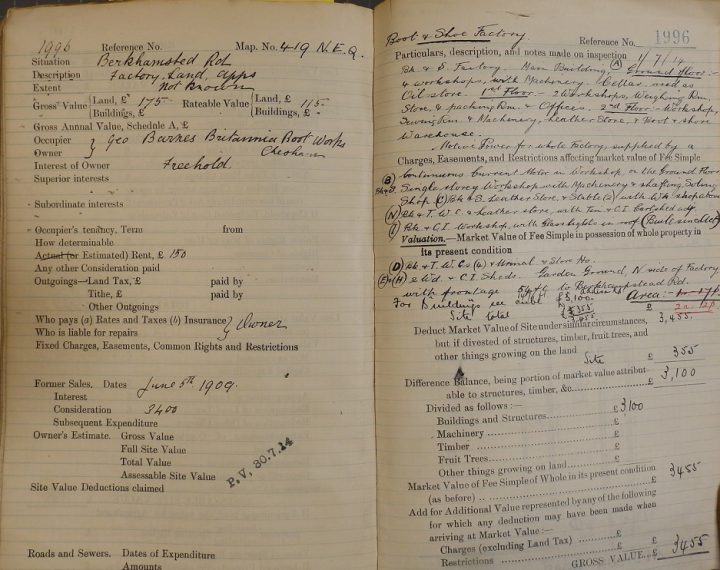

Information from landowners and surveyors was written up into small printed bound volumes called field books. Each field book contains space to record 100 plots. The amount of information entered in the field books varies considerably. Unfortunately, where a field book entry says ‘see file’ or ‘see notes’, this paperwork is not believed to have survived.

Field books usually include:

- the names of owner and occupier

- the owner’s interest (freehold, copyhold, etc.)

- details of tenancy (term and rent)

- the area covered by the property

- figures entered for the purpose of valuation (i.e. market value)

They sometimes include:

- the date of erection of buildings

- number of rooms

- state of repair

- liability for rates, insurance and repairs

- date(s) of previous sale(s)

- a sketch-plan of the property

The first two pages of a field book entry for land occupied by a boot and shoe factory in Chesham, Buckinghamshire (catalogue reference IR 58/39367).

See section 5 for advice on how to find field books.

3.3 Valuation books

Valuation books (also known as ‘Domesday books’) were the first major record created by the Valuation Office at the start of the survey. They are distinct from the field books, which were the final record compiled after the survey was completed, and which usually contain more information. See section 6 for advice on how to find valuation books.

3.4 Survey forms

In the course of the survey a number of forms were used to collect information. Some of them were sent to land and property owners for completion. See section 7 for advice on how to find examples of surviving forms.

4. Online records

The Genealogist website has digitised images of plans and valuation books that can be searched by name. More information can be found on their website but coverage of the country is incomplete.

Records can also be accessed using their Map explorer. Select “1910 Lloyd George Domesday” as the top layer. The map will show England and Wales with a coloured area showing where digitised records can be found. As you zoom in to the area you are interested in this will resolve to coloured patches, if information is available, and eventually into a large scale map with pins for properties or parcels of land. Click on the pin to see an image of the valuation book for that property.

5. How to find plans (maps)

To find and see a plan you will need to identify its document reference using our online catalogue. The plans are not online and you will need to consult them at The National Archives.

You can refer to the National Library of Scotland’s Ordnance Survey map page to identify an Ordnance Survey sheet number and then search Discovery for the corresponding plan or plans (see 5.1). For maps of London, see 5.2.

If you are at The National Archives, you can use the county index maps held there in the Map and Large Document Reading Room (see 5.3).

5.1 Using the National Library of Scotland’s Ordnance Survey map page

Go to the National Library of Scotland’s Ordnance Survey map page.

In the pane on the left ‘Choose a map series’, select ‘County series 25 inch’.

To find a place, you can either search by place name or grid reference, or you can zoom the map and select the appropriate rectangle on the map.

You can choose a background map to display to help you find the exact place you are looking for. Options include modern maps, satellite images or old Ordnance Survey maps.

When you have found the appropriate place, click on the area and look at the results box on the right of the screen. This box shows maps available at the National Library of Scotland but displays the Ordnance Survey sheet name, Roman numerals and number you need to search for the plan at The National Archives e.g. Warwickshire XXXIII 15.

Go to 5.4 to look up the sheet number in our online catalogue.

A cross section of the plan shown in section 3.1. The assessment numbers are marked in red handwritten script.

5.2 London maps

Use the Genealogist website to either zoom in on the part of London you are interested in on the map explorer, or try a name search. See Online records for more detailed instructions.

Maps used for the London region (see the appendix at 11.2 below) are at the 1:1056 scale. To find these using the National Library of Scotland’s map page you should search at the 1:1056 scale in the ‘Choose a map series’ box.

Go to 5.4 to look up the sheet number in our online catalogue.

5.3 Using original county index maps

You can use unique annotated county index maps to identify individual sheet numbers at the 1:10,560 and 1:2,500 scales. These index maps are available at The National Archives building in Kew.

Go to 5.4 to look up the sheet number in our online catalogue.

5.4 Finding plans in Discovery, The National Archives online catalogue

Perform an advanced search in Discovery with Department code IR in the reference box, using the Ordnance Survey sheet county or place name and Roman numerals (numerals in upper case) plus Arabic numerals, and the date 1910 in the date field.

For example this search.

The plans you need will say Valuation Office in the catalogue description (the search may also find Tithe Redemption Office maps).

You may need to look at more than one plan to find the one used for the property you are interested in, which should be annotated with handwritten numbers.

There may be maps for the area you are interested in at more than one scale. Most areas will be covered by the 25 inch scale county map (1:2,500) but for towns there may be maps at larger scales such as 1:1,250, while London maps are at 1:1056 scale. The Discovery search will find maps at all scales.

Guidance on understanding the map scales used for the survey can be found in the appendix at the foot of this guide.

Another explanation for the situation where the property you seek lacks a handwritten plot number is that a county or Valuation District boundary ran through the area. Two different local offices each annotated a copy of the map that fell within their area. If a map shows parts of two or more different income tax parishes, the boundaries between them are often shown as yellow lines. Look for the same sheet number in a different county or Valuation District.

It is also possible to browse the catalogue using the links in the appendix at the foot of this guide. The plans, however, are arranged by Valuation Office regions and districts, which do not always equate to counties, and districts may have more than 100 maps, so this search method can be time-consuming. Since 1910, regions, districts and other divisions of the Valuation Office have been reorganised on a number of occasions. Plans have been transferred from closed district valuation offices to new ones. You may, therefore, need to examine plans in more than one district before identifying the appropriate plot(s).

Once you have the plan in front of you, look for the assessment number (or ‘hereditament number’) of the individual property or parcel of land, handwritten, usually in red or black ink. Look at the margin of the plan to see if the income tax parish may be written there, and if so, make a note of this, too.

6. How to find field books

The key to finding a field book is to first find the respective plan for a place to ascertain the assessment number and income tax parish where possible (see section 4).

The field books are arranged alphabetically by valuation district and, within districts, by income tax parish.

Many income tax parishes were made up of a number of civil parishes, but were usually named after the place with the name nearest the beginning of the alphabet. If you cannot find the place you want in our catalogue, look for other local places, especially those beginning with a letter near the beginning of the alphabet.

There is no place or street index to the field books.

6.1 Using our catalogue to find a field book

Once you know the assessment number and income tax parish, follow these steps:

- Step 1: Use our catalogue to search IR 58 by the name of the income tax parish – this will usually produce multiple results for IR 58 documents

- Step 2: Use the drop-down menu on the search results page to sort the results by ‘Reference’ (the default display for search results is by ‘Relevance’)

- Step 3: Once sorted by reference, scan down through the results to find the assessment number range which covers the assessment number you are looking for

- Step 4: Click on the title of the field book to view the full catalogue description and the ordering and viewing options

- Step 5: Order the original field book (if you are on site, in our building) or a copy (if you are off site)

7. How to find valuation books

A number of valuation books for the City of London and City of Westminster are held at The National Archives. For other areas you will need to search in local archives for surviving valuation books.

Search for City of London and City of Westminster valuation books by browsing through record series IR 91.

8. How to find survey forms

Survey forms were not systematically retained by the Valuation Office but we hold some examples among the records of other government departments who themselves provided information for the survey about land they occupied. Copies of forms have, in some instances, also been retained by landowners for their own use and are sometimes found among estate records, solicitors’ papers and at local archives.

The forms include:

| Type of form | What was form used for? | Where to find examples of forms |

|---|---|---|

| Form 4-Land | This form was originally filled in by the landowners and the information later transferred to the field books. Some field books may contain nothing more than a note to ‘see Form 4’. | Example of forms filled out by the Admiralty are in ADM 116/1279, Forestry Commission are in F 6/16, Rhymney Railway Company are in RAIL 1057/1714. |

| Form 37-Land | Form 37-Land contains the statement of provisional valuation made on the completion of the survey which was retained by the district valuation office. | None held at The National Archives. Surviving sets of Form 37-Land are held at local record offices or remain in district valuation offices. |

| Form 36-Land | A copy of Form 37-Land was sent to the landowner. | A few examples of Form 36-Land are in RAIL 1057/1714. |

A set of blank forms is preserved as ‘Various Specimen Forms’ in IR 9/62-64.

9. Records on the work of the Valuation Office

Some records on the work of the Valuation Office include:

- a number of files about the Valuation Office itself, including some instructions to valuers in IR 40

- a set of papers about the land tax proposals and discussions prior to the 1909 budget in IR 73/6

- draft notes about the organisation of the Land Valuation Department drawn up in June 1910 in IR 74/146

- reports on the progress of the original valuation in IR 74/148

- a copy of the report of a Committee appointed to inquire into the organisation of the Valuation Office in 1920 in IR 75/114

- an account of the Office’s history and functions was compiled in 1920; a copy is in IR 74/218

- lists of addresses of district valuation offices showing the changing distribution of offices between 1913 and 1919 in IR 40/2878

- a number of Treasury files in T 1, T 170, T 171 and T 172 contain papers on the work of the Valuation Office. Papers explaining the mathematics of increment value duty calculations, and copies of the rules made by the Inland Revenue Commissioners are in T 1/11209 and T 170/4

- Inland Revenue memoranda in T 171/28 and T 39

- reports of the Inland Revenue Solicitor in IR 99/29B-42

Records which relate to specific cases:

- press cuttings about individual legal cases, c.1914, are in IR 83/54

- other memoranda about court cases are in T 171/39

- a few petitions, including special cases and awards, are in E 186

- papers relating to one celebrated test case, Lady Emily Frances Smyth v Commissioners of Inland Revenue, are in IR 40/2502

- papers on the case, Commissioners of Inland Revenue v Lumsden, are in T 172/100

- records of the Land Value Reference Committee set up under the Act to regulate procedure in appeals against assessment are in LT 5. They include registers of appeals and a few sample case files

10. The Finance (1909-1910) Act and its legacy

The Valuation Office Survey was initiated by the Finance (1909-1910) Act (10 Edw. VII, c.8 section 26(1)) which provided for the levy and collection of a duty on the increment value of all land in the United Kingdom.

The main object of the Act was to tax that part of the capital appreciation of real property which was attributable to the site itself, i.e. excluding that arising from crops, buildings and improvements paid for by the owners. In this way, private owners were required to surrender to the State part of the increase in the site value of their land which resulted from the expenditure of public money on communal developments such as roads or public services.

Increment value duty, as this levy was called, was based on the difference between the amount of two valuations. The site value as at 30 April 1909 constituted the ‘datum line’ for the purposes of increment value duty. A second site value was to be taken on the occasion of any subsequent sale or grant of a lease, or transfer or interest in a piece of land, or the subsequent death of a land owner, to determine any potential payment of increment value duty. The assessment of the site value on subsequent occasions was a recurring operation which formed part of the role of the Valuation Office until increment value duty was repealed by the 1920 Finance Act (10 and 11 Geo. V, c.18).

Although the 1910 land value tax was abolished following the 1920 Finance Act, the Valuation Office remained. Its modern-day successor is the Valuation Office Agency.

11. Further reading

Most of the following recommended publications are available in The National Archives Library.

A range of books can also be purchased from the National Archives’ shop.

Geraldine Beech and Rose Mitchell, Maps for Family and Local History (2004)

Brian Short, Land and Society in Edwardian Britain (2005)

Brian Short and Mick Reed, An Edwardian Land Survey: the Finance (1909-10) Act 1910 Records (Journal of the Society of Archivists, 8(1), pp. 82-3, and 8(2), 1986, pp. 95-103)

Brian Short and Mick Reed, Landownership and Society in Edwardian England and Wales: The Finance (1909-10) Act 1910 Records (University of Sussex, 1987)

Brian Short and Mick Reed and Bill Cauldwell, The County of Sussex in 1910: Sources for a New Analysis, (Sussex Archaeological Collections, vol. 125, 1987, pp. 199-224)

12. Appendices

12.1 Understanding map scales

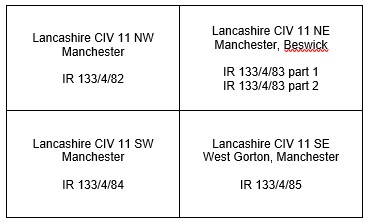

At a scale of 1:2500 each grid rectangle represents an area of land which is 1 x 1.5 miles (1.6 x 2.4 km) on the ground. The vast majority (c.82%) of available VO maps are drawn at a scale of 1:2500. One of these maps covers the entire rectangular area. They were sufficient in detail for the majority of rural areas: countryside and villages.

In some small towns there was need for greater detail. Here you may find there are four further maps drawn at a scale of 1:1250 which cover the same rectangular grid area. Each of these four maps therefore represents an area of land which is 0.5 x 0.75 miles (0.8 x 1.2 km) on the ground.

The density of the larger towns and cities meant even greater detail was required by VO. Here there may be 25 further maps drawn at a scale of 1:500 which, put together, cover the same original rectangular grid area. Each of these 25 maps therefore represents an area of land which is just 0.04 x 0.06 miles (64 x 96 metres) on the ground.

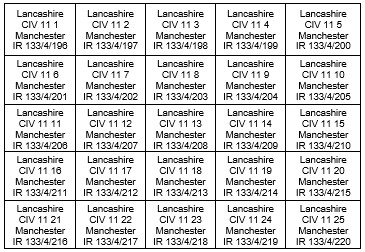

12.2 Catalogue arrangement of plans

The catalogue references for Valuation Office Survey plans, arranged by region and district are shown in the table below.

| Region | Area | Reference |

|---|---|---|

| London Region | Merton District | IR 121/1 |

| Barking District | IR 121/2 | |

| Barnet District | IR 121/3 | |

| Bexley and Greenwich District | IR 121/4 | |

| Bromley District | IR 121/5 | |

| Camden District | IR 121/6 | |

| City of London District | IR 121/7 | |

| Croydon District | IR 121/8 | |

| Ealing District | IR 121/9 | |

| Enfield District | IR 121/10 | |

| Hammersmith and Fulham District | IR 121/11 | |

| Harrow District | IR 121/12 | |

| Hillingdon District | IR 121/13 | |

| Islington District | IR 121/14 | |

| Kensington and Chelsea District | IR 121/15 | |

| Lambeth District | IR 121/16 | |

| Redbridge District | IR 121/17 | |

| Richmond upon Thames District | IR 121/18 | |

| Southwark District | IR 121/19 | |

| Tower Hamlets District | IR 121/20 | |

| Westminster 1 District | IR 121/21 | |

| Westminster 2 District | IR 121/22 | |

| South East Region | Brighton District | IR 124/1 |

| Canterbury District | IR 124/2 | |

| Canterbury (Maidstone) District | IR 124/3 | |

| Eastbourne District | IR 124/4 | |

| East Kent District | IR 124/5 | |

| Medway District | IR 124/6 | |

| Reigate District | IR 124/7 | |

| Tunbridge Wells District | IR 124/8 | |

| Worthing District | IR 124/9 | |

| Wessex Region | Bournemouth District | IR 125/1 |

| Dorset County West District | IR 125/2 | |

| Guildford District | IR 125/3 | |

| NE Hampshire District | IR 125/4 | |

| North Surrey District | IR 125/5 | |

| Portsmouth (records destroyed) | IR 125/6 | |

| Salisbury District | IR 125/7 | |

| Solent District | IR 125/8 | |

| Solent (IOW) District | IR 125/9 | |

| Southampton (records destroyed) | IR 125/10 | |

| Wiltshire North District | IR 125/11 | |

| Central Region | Aylesbury District | IR 126/1 |

| Bedfordshire District | IR 126/2 | |

| East Berkshire District | IR 126/3 | |

| Hertfordshire North District | IR 126/4 | |

| Northampton District | IR 126/5 | |

| Oxford District | IR 126/6 | |

| Reading District | IR 126/7 | |

| St Albans District | IR 126/8 | |

| South Buckinghamshire District | IR 126/9 | |

| Watford District | IR 126/10 | |

| East Anglia Region | Basildon District | IR 127/1 |

| Cambridge District | IR 127/2 | |

| Chelmsford District | IR 127/3 | |

| Colchester District | IR 127/4 | |

| Ipswich District | IR 127/5 | |

| Norwich District | IR 127/6 | |

| Peterborough District | IR 127/7 | |

| Peterborough (King’s Lynn) District | IR 127/8 | |

| St Edmundsbury District | IR 127/9 | |

| Western Region | Barnstaple District | IR 128/1 |

| Bath District | IR 128/2 | |

| Bristol District | IR 128/3 | |

| Cheltenham District | IR 128/4 | |

| Cornwall District | IR 128/5 | |

| Exeter District | IR 128/6 | |

| Gloucester District | IR 128/7 | |

| Plymouth District | IR 128/8 | |

| Somerset District | IR 128/9 | |

| Torbay District | IR 128/10 | |

| West Midland Region | Birmingham District | IR 129/1 |

| Coventry District | IR 129/2 | |

| Hereford and Worcester District | IR 129/3 | |

| Kidderminster District | IR 129/4 | |

| Lichfield District | IR 129/5 | |

| Sandwell District | IR 129/6 | |

| Walsall District | IR 129/7 | |

| Warwick District | IR 129/8 | |

| Wolverhampton District | IR 129/9 | |

| East Midland Region | Boston District | IR 130/1 |

| Derby District | IR 130/2 | |

| Grimsby District | IR 130/3 | |

| Leicester District | IR 130/4 | |

| Lincoln District | IR 130/5 | |

| Loughborough District | IR 130/6 | |

| Mansfield District | IR 130/7 | |

| Matlock District | IR 130/8 | |

| Nottingham District | IR 130/9 | |

| Welsh Region | Abergavenny District | IR 131/1 |

| Bangor District | IR 131/2 | |

| Bangor (Colwyn Bay) District | IR 131/3 | |

| Cardiff District | IR 131/4 | |

| Dyfed District | IR 131/5 | |

| Merthyr Tydfil District | IR 131/6 | |

| Newport District | IR 131/7 | |

| Pontypridd District | IR 131/8 | |

| Swansea District | IR 131/9 | |

| Wrexham District | IR 131/10 | |

| Wrexham (Welshpool) District | IR 131/11 | |

| Liverpool Region | Chester District | IR 132/1 |

| East Cheshire District | IR 132/2 | |

| Liverpool District | IR 132/3 | |

| Shropshire District | IR 132/4 | |

| Stafford District | IR 132/5 | |

| Stoke-on-Trent District | IR 132/6 | |

| Warrington District | IR 132/7 | |

| Wigan District | IR 132/8 | |

| Manchester Region | Bolton District | IR 133/1 |

| East Lancashire District | IR 133/2 | |

| Lancaster District | IR 133/3 | |

| Manchester District | IR 133/4 | |

| Preston District | IR 133/5 | |

| Rochdale District | IR 133/6 | |

| Salford District | IR 133/7 | |

| Stockport District | IR 133/8 | |

| Yorkshire Region | Bradford District | IR 134/1 |

| Calderdale District | IR 134/2 | |

| Doncaster District | IR 134/3 | |

| Harrogate District | IR 134/4 | |

| Hull District | IR 134/5 | |

| Kirklees District | IR 134/6 | |

| Leeds District | IR 134/7 | |

| Sheffield District | IR 134/8 | |

| Wakefield District | IR 134/9 | |

| York District | IR 134/10 | |

| Northern Region | Carlisle District | IR 135/1 |

| Cleveland District | IR 135/2 | |

| Darlington District | IR 135/3 | |

| Durham District | IR 135/4 | |

| Newcastle District | IR 135/5 | |

| Newcastle (Tyneside) District | IR 135/6 | |

| Northumberland District | IR 135/7 | |

| South Lakeland District | IR 135/8 | |

| Sunderland District | IR 135/9 |