Extract from The Times, 19 March 1925. This reported the response of economist J.M. Keynes on the return to the Gold Standard (Catalogue ref: T172/1499B)

Transcript

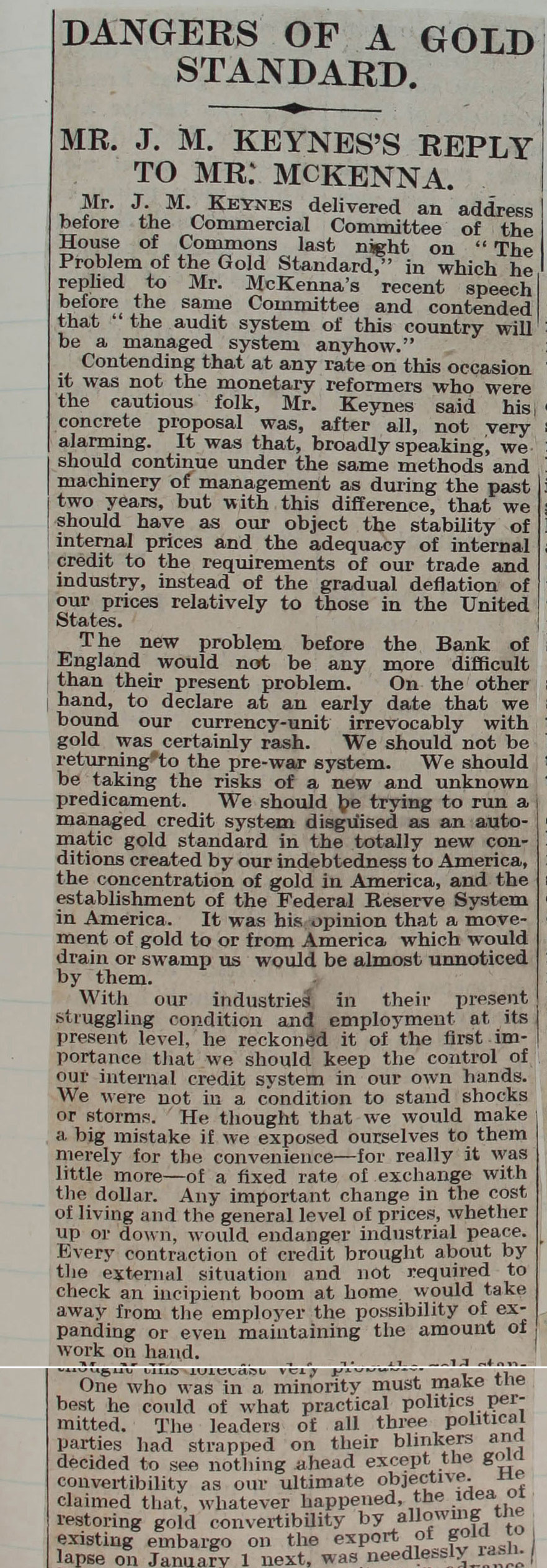

DANGERS OF A GOLD STANDARD

MR.J.M. KEYNES’S REPLY TO MR McKENNA

Mr. J.M. Keynes delivered an address before the Commercial Committee of the House of Commons last night on “The problem of the Gold Standard”, in which he replied to Mr. McKenna’s recent speech before the same Committee and contended that “the audit system of this country will be a managed system anyhow”.

Contending that at any rate on this occasion it was not the monetary reformers who were the cautious folk, Mr. Keynes said his concrete proposal was, after all, not very alarming. It was that, broadly speaking we should continue under the same methods and machinery of management as during the past two years, but with this difference, that we should have as our object the stability of internal prices and the adequacy of internal credit to the requirements of our trade and industry, instead of the gradual deflation of our prices relatively to those in the United States.

The new problem before the Bank of England would not be any more difficult than their present problem. On the other hand, to declare at any early date that we bound our currency-unit irrevocably with gold was certainly rash. We should not be returning to the pre-war system. We should be taking the risks of a new and unknown predicament. We should be trying to run a managed credit system disguised as an automatic gold standard in the totally new conditions created by our indebtedness to America, the concentration of gold in America, and the establishment of the Federal Reserve in America. It was his opinion that a movement of gold to or from America which would drain or swamp us would be almost unnoticed by them.

With our industries in their present struggling condition and unemployment at its present level, he reckoned it of the first importance that we should keep the control of our internal credit system in our own hands. We are not in a condition to stand shocks or storms. He thought we would make a big mistake if we exposed ourselves to them merely for the convenience—for really it was little more—of a fixed rate of exchange with the dollar. Any important change in the cost of living and the general level of prices, whether up or down, would endanger industrial peace. Every contraction of credit brought about by the external situation and not required to check an incipient boom at home would take away from the employer the possibility of expanding or even maintaining the amount of work at hand.

[…]

One who was in a minority must make the best he could of what practical politics permitted. The leaders of all three political parties had strapped on their blinkers and decided to see nothing ahead except the gold convertibility as our ultimate objective. He claimed that, whatever happened, the idea of restoring gold convertibility by allowing the existing embargo on the export of gold to lapse on January 1 next was needlessly rash.